|

|

||

|

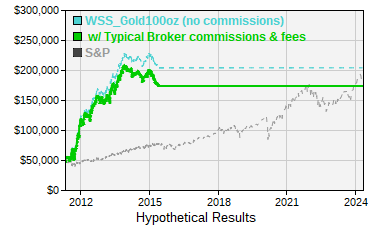

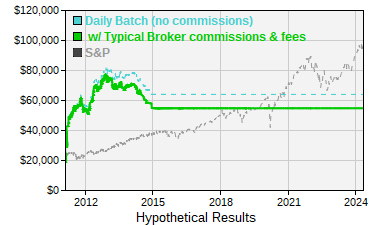

Past results are not necessarily indicative of future results. These results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program, which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results. The following are material assumptions used when calculating any hypothetical monthly results that appear on our web site. Profits are reinvested. We assume profits (when there are profits) are reinvested in the trading strategy. Starting investment. For any trading system on our Web site, we assume you will invest the amount that appears as the starting amount of that system's performance chart. All fees are included. When calculating monthly returns, we try to estimate and include all the fees a typical trader incurs when AutoTrading using AutoTrade technology. This includes the subscription cost of the strategy, plus any per-trade AutoTrade fees, plus estimated broker commissions. There is a substantial risk of loss in futures and forex trading. Assume you will lose money. Don't trade with money you cannot afford to lose. Copyright (C) 2012 Collective2 LLC. |

||