| |

|

|

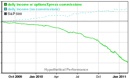

About the author Matthew Klein is the founder of Collective2. In addition to starting Collective2, Matthew has also written two novels, Con Ed and Switchback, and is currently working on his third book. About Collective2 Collective2 analyzes and reviews thousands of trading systems. Its honest and hard-hitting method has won it hundreds of enemies around the world. But it's worth it, because our users adore us. New at C2 this month Even uglier charts! Our system charts are even uglier than before. No, I'm not talking about some new nauseating color scheme, or an even-tinier dizziness-inducing typeface. What I'm referring to is that fact that, now, all charts show brokerage commission costs and system subscription fees. Even cooler: You can flip between C2-compatible brokers to see how each broker's commissions affects performance. Just click "Change commission plan..." on the upper left of each chart. When you change the commission plan, in addition to the chart updating, the "monthly returns table" at the top of the page will automatically change as well. While all the results we show are hypothetical, we think this new feature makes C2 charts and analysis even more useful. And yes, sometimes the results are ugly:

For some systems, when you factor in real-world commissions, results can look ugly.

Have you checked out our sister site, YoutualFunds.com? YoutualFunds are sort of like ETFs, sort of like mutual funds... and entirely customized by you. Anyone can run his own YoutualFund, and then friends, family, and even strangers can buy and sell your fund at a real broker. Fund Managers who perform well earn real money. Starting a fund is completely free. Come check it out! |

Putting ass back in "Asset Management"

Three trading systems that failed A lot of trading-system sites like to brag about how people made money on their site.

At Collective2, we do things differently. We talk about how people lost money. Every now and then we review bad trading systems on our site. Why our obsession with failure? Because failure, more than success, is interesting. Not just in a snarky,

let's-kick-people-when-they're-down kind of way. When trading systems fail,

it gives investors a chance to ask questions. Were there warning signs that

should have been heeded? Is there anything that these failed systems have in common?

Without further ado, here is our latest list of failed systems, with

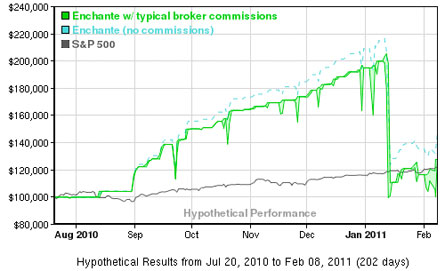

analysis about what went wrong in each case. Failed System #1:Enchante

a perfect example of a Martingale strategy It has a French name, which is fitting, considering that it's a perfect example of the

"Martingale strategy," which was developed in 18th-century France. The French were

crazy about Martingale strategies - and who can blame them? - every kid "invents" the

strategy the first time he visits a casino or opens his first forex trading account.

The Martingale strategy is simple. Bet one unit. If you lose, double your bet.

Repeat until you win. It sounds good in theory, because, if you have an unlimited bankroll, you can't lose.

The problem is: You don't have an unlimited bankroll.

The chance of losing a sequence of bets is much higher than most people intuitively think.

Don't fall for the fallacy of saying: "The chance of flipping a coin six times and

getting six heads in a row is very unlikely." Getting six heads in a row the very first time

you flip six coins is indeed unlikely (1.56%), but that's not what you need to measure.

Measure the chance of getting six heads in a row over a modestly long period of time

- say, 150 flips. The chance of losing 6 times in a row during that period rises to 70.7%.

It's even worse in the world of trading, where "bets" aren't independent of each other, the way coin

flips are. There are trends, which means that when something starts moving against you, it is more likely to continue

to do so. Start betting against a trend, and soon you'll have your sixth coin as heads.

This is exactly what happened to Enchante. More than once, in fact. You can see it in the

equity chart. It exhibits the classic pattern of a Martingale system:

Lots of little wins. The system developer feeling good. Subscribers piling in. Then - kablooey!

- a single huge loss, wiping out most - if not all - of the previous wins. Failed System #2:

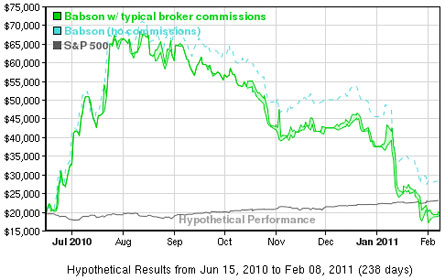

Babson

even golden harmonics and hidden geometry couldn't save it This system developer burst onto the Collective2 scene back in June, with a flurry of public

posts on the Collective2 Public Forums, proclaiming a nearly-magical system that uses

"Hidden Sacred Geometry" and that bases its "buys and sells ... upon the laws of physics."

The developer must have been referring to this particular law of physics -

"what goes up must come down" - because that is exactly what we have witnessed here:

The system, and its history on C2, is a perfect example of how easy it is to be fooled by

randomness (hat tip, Nassim Taleb). The system started off amazingly strong (look at the run-up between June and August,

at extreme left of the chart). Maybe its success was

due to some kind of Hidden Sacred Geometry. Or maybe it was due to plain old dumb luck.

Whichever the cause, the early run-up gave the system developer a strong platform for promoting

his system on Collective2, and for attracting a surprisingly large number of AutoTraders.

The system - and its subscribers - all subsequently rode the system equity curve back down

to where it began. And C2 can't escape a poke in the eye, either. Every system on Collective2 is assigned

a numerical "C2 Score" of between 100 and 999. The C2 Score takes into account many different

mathematical factors, but one of the factors most heavily weighted is the amount of real-world

autotrading being done by system subscribers. (The theory being: Investors will only put money

into good systems, so C2 relies strongly on their judgment.) Because of this, Babson still has an

embarrassingly high C2 Score of 995.

Shame on us. Failed System #3:

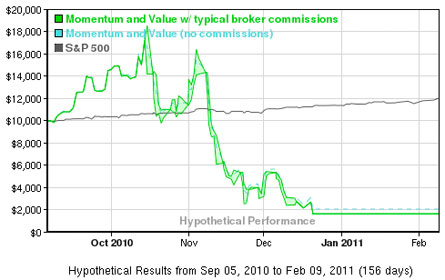

Momentum & Value too bad the momentum is in the wrong direction

The truth is, this system isn't so bad - it's not in the same class of egregious offenders as the

first two we profiled. Sure, it has lost a lot of money; but it didn't flame out in fiery ruin,

the way many trading systems do. Rather, it descended slowly and implacably, like a red

velvet curtain at the end of a Puccini opera. It didn't double-down on its bets, Martingale style, and it didn't loudly proclaim that it had

discovered a new Cosmic Geometry, or anything silly like that. It just bought long options

positions, and watched as they dwindled into worthlessness. For those of you who aren't familiar with options, this is how they work.

Strip away all the mumbo-jumbo, and here's what options are: they are an instrument that

allows you to bet where a stock price will be, at a certain date in the future.

There are two ways to trade a single option contract. You can go long the option (that is, buy it),

or you can go short (sell it). Selling "naked" options short is commonly perceived to be extremely

risky - and indeed it is - so much so, that many brokers do not allow traders to even engage in

the practice without a substantial account balance. The reason selling options short is risky is

that the amount you can lose is theoretically unlimited. In contrast, buying an option "long" is often perceived (wrongly, I should point out) as a safer

strategy. Well, it's safer in the sense that your loss is bounded by the amount you initially

paid for the option. Pay $100 for an option, and that's the most you can lose. Alas, that doesn't make an option safe. This is because - while your loss is capped at

the amount you pay - this doesn't prevent the value of what you bought from plummeting to zero. For a great example of how this works, study the trades of the Collective2 trading system

called Momentum and Value. Let's look at a specific case. On October 8, 2010, the system bought 33 options contracts that

were Nov 13 calls on the stock ReneSola. Now, for those of you who don't live, eat, and

breathe options, here's what that means: The system made a bet that on Nov 19, 2010, the stock

price for SOL would be greater than $13 dollars per share. Indeed, on October 8, when the system made this bet... er, excuse me, made this investment... SOL

was trading around $13 per share. Here's the chart, courtesy of Google Finance:

You can see from the chart that this wasn't a crazy or reckless position. After all, the price of

SOL (yes, it's an ironic stock symbol, given the outcome) was around $13 at the time the option was purchased. But the comfort that brokers used to offer to their high-net-worth clients buying options - that you

can only lose what you invest, damn it! - is worth studying, in light of this example.

The trading system bought 33 contracts, at $120 dollars per contract. That means it

laid out about $4,000 in cash. The day of reckoning came finally on November 19, on "option expiration day." The

trading system would have profited handsomely had SOL shares been trading above $13 per share.

Alas, SOL closed the day at $9.51. And here, dear reader, is your lesson in the risks of supposedly less-risky long option buying.

The price of SOL ($9.51) was only 27% below the 13 strike price. So did that mean that the option

position owned by the Momentum and Value system only lost 27% of its value? Uh, no. The option expired worthless. Worthless meaning: all $4,000 bucks of the investment

were vaporized. Goodbye, thank you, and don't let the door hit you on the way out. The trading system enjoyed a similar streak of worthless option expirations through the end

of last year. Finally, the system retired from Collective2 with a Model Account balance of $2,000.

It had started on Collective2 with $10,000. Which means it lost 80% of its value trading in what

is generally perceived as low-risk option strategy. Mercifully, there were no C2 AutoTraders

for this system.

Conclusion

The point of reviewing these three systems is to learn from mistakes. The best kind of mistakes

to learn from are the ones that other people make. (Learning from your own mistakes, while a

powerful pedagogical method, hurts like hell.) So what did we learn today? Interested in learning more? Collective2 analyzes over 16,000 trading strategies.

We've talked only about three of them. Come see the other 15,997+. |