| |

| |

About the author   These brokers join the growing ranks of C2-Compatible brokers. Remember, you can trade any Collective2 trading system automatically in any C2-Compatible broker. The current list includes:   FXCM UK   Gain UK       Your broker not listed here? Do not fret. We're expanding the roster of C2-Compatible brokers each day. To speed up the process, email your broker and tell him or her that you need them to become C2-Compatible. It's a quick and painless process. (For them, anyway. For us, it's a pain in the ass, but it's the only way we're going to expand into fancier office space - and maybe I'll be able to get that Maserati I've had my eye on - so go ahead, don't feel bad.)

^ OEC Equities is part of optionsXpress, Inc., doing business as OEC Equities.

All brokers' logos and trademarks and service marks are the property of the respective firms. Collective2 LLC is unaffiliated with these firms. |

Why you should date an ugly girlfriend

I run Collective2.com, the trading system Web site. It's a strange business, because I often see my customers making bad decisions. In that way, I'm no different than a drug dealer or a hooker. Like people in those professions, I see customers making poor choices all the time - and, like people in those professions - I've learned that customers don't really want to hear what I think. But I'll tell you anyway. If I can save one trader from making one bad choice, then sending you this email was worthwhile. So, in that spirit, here is my advice for the day: Date an ugly girlfriend. A sad (but typical) story Before I explain what I mean by "ugly girlfriend," and how it relates to trading systems, let me tell you a story. The other day, I received an email from a customer. To avoid hurt feelings, I'll change his words and hide his identity, but essentially he wrote: "Dear Matthew: I lost money when I traded System X. But I've learned a valuable lesson. I'll never do that again!" He concluded his letter by saying: "And now I'm going to start trading System Y instead. It has been performing great recently." Before I replied to my correspondent, I did a little research. I looked first at the initial system he chose - System X - a system that seemed to start off great, but eventually cratered, after placing a huge bet on the direction of the Euro currency that didn't work out. Next, I looked at System Y. This was the trading system that my customer chose after learning his valuable lesson. Alas, what I saw in System Y was not very encouraging. I saw the same characteristics that System X demonstrated before it collapsed: a series of beautiful, profitable trades; a sexy rising equity curve... and also a growing number of huge gambles that, so far, had paid off and been profitable. But of course you know how the story ends, don't you? How the story ends Let me show you the end of the story, using pictures. First, here's a picture of Trading System Y - remember, that's the new system, which my customer chose after learning his valuable lesson. This picture shows what System Y looked like at the time the customer wrote me.

Now let me show you a picture of the system a few weeks later.

Why you should not fall for a beautiful picture The customer made a foolish mistake when he chose system Y. He forgot the key rule of trading: What's that? You don't remember that rule from all your trading e-books and seminars and webinars? Then let me put it in more familiar terms: Ah, that's better. Whichever way you remember the rule, the point is the same. There is no such thing as a system that makes money without risk. If there were such a system, then I assure you it would not be offered on my rinky-dink web site - not for any price - and certainly not for $99 month, with a 14-day free trial. No, sir - such a system would be locked away, hidden deep underground, in a lead-lined chamber, protected by laser tripwires, and ringed by anti-personnel mines. So if you see a system that looks too good to be true, then I assure you it is too good to be true. Trading Systems = Risk If you accept my rule about trading systems (You can't make money without risk) then two corollaries flow from it: and If you see that a trading system is making a lot of money, it is taking a lot of risk.1 These rules apply to all trading systems - whether the risk is visible to you, or not. What do I mean when I talk about risk being "visible" or not? When you go to Collective2, you'll see that we make an effort to point out the risks of each trading system. For example, each trade in a system's trading record is given a risk rating, like this:

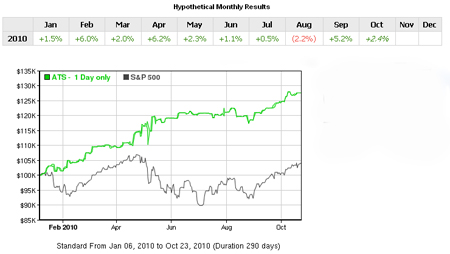

Note that the risk rating ("Low," "Normal," "High," or "Extreme") is independent of the actual profit or loss of the trade. Thus you will likely see a profitable trade that is rated as "extremely" risky. Indeed, if you see too many "extreme" risk flags - even for a system that has never had a losing trade - you should probably steer clear of the system. But not all risk is visible But here's the problem. Not all risk is visible. Even though Collective2 makes an effort to show a trading system's risk, we can be wrong. Indeed, we can entirely miss the mark and not see the risks that are inherent in a trading system. Let me give you an example. An amazing system that never lost money in 30 years Imagine that I tell you that I have found an amazing "system" that makes money, year after year. Sure - I admit - every now and then, it has a losing month or two, but overall, it generates steady returns every year. How steady? Well, I've been running the system for thirty years, and during that time, it never lost money overall in a single year. Sound like a great system? Well, it was. It was called the U.S. housing market. And if you were a financial go-getter in the early 2000's, you would have thought that buying mortgage-backed securities was a great strategy, because the underlying asset guaranteeing those securities (U.S. residential real estate) never substantially declined on a national basis - not since records started being kept three decades earlier. A great system for about thirty years; Until... well, until it wasn't such a great system. My point here isn't to say, "The U.S. housing crisis was obvious." It surely wasn't - not to me, not to government officials, not to economists. My point is to say that - because people couldn't see any risk - they assumed there was none. Beautiful systems hide dark secrets Instead of trying to figure out each system's risk - whether it is high or low - what if we just start with the simple assumption that all trading systems are risky? What if we begin our analysis by stating the obvious: that there is no such thing as a free lunch. To put it another way, what if we admit the dirty secret or trading: that if you want to make money trading, you need to lose money sometimes. It is my theory (and it's only a theory, mind you - I'm no expert, and I could be wrong) that the trading systems that look the most beautiful are actually the most dangerous. This is another example of the "there is no such thing as a free lunch" rule. A system that looks great, without any losses, must surely be taking large risks. On the other hand, an ugly system that makes decent money, but also sometimes loses money, might be exactly what it seems. That is to say: it might be a reasonable trading system that wears its risks on its sleeve. Under this theory, if you see a trading system that looks beautiful, it isn't because there are no risks. It is because the risk is hidden from you. That's why I recommend ignoring the beautiful trading systems, and sticking with the ugly ones instead. Look for an ugly girlfriend This is really the same lesson that our parents taught us when we were young boys, just starting to date girls: that looks on the outside hardly tell us what's on the inside. Indeed, the real lesson of dating and marriage - the lesson that it takes some poor souls decades to learn - is this: beautiful people tend to be the most boring, and the most tedious to be around. In general, beautiful people are train wrecks, for all sorts of reasons we don't have time to examine here. I suspect that the same holds true for trading systems. Collective2's System Finder show a lot of beautiful systems - "trading system pornography," I like to call it. Fun to look at, every now and then, when you're alone in the house - but perhaps not something you ought to marry. In contrast, those systems that you ought to create a long-term relationship with have real warts. You can see their flaws, because they're readily apparent. Here's a real a trading system, not a pornographic one. It had a good month in February, and another in September, but except for those exceptions, it has been "merely" chugging along. I say "merely" with tongue-in-cheek quotation marks, because who wouldn't have been happy earning "merely" 1% each month - with bank savings accounts paying 0.3% each month.

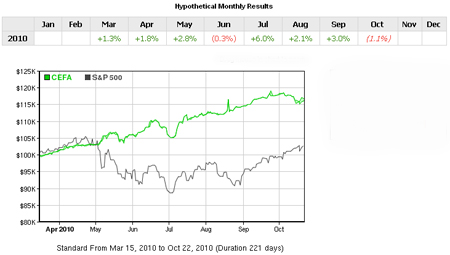

Or here's another "ugly" system you might consider dating - or at least inviting out for a cup of coffee:

I picked these systems not because they are so great - nor because they are risk free (they certainly are not that - all trading involves risk, and these might blow up, too!) - but because their performance - at least, when compared to trading system pornography - seems somewhat ugly. Ugly is the new pretty Perhaps this is the difference between the losers and the winners in the trading game. The losers are constantly chasing that big score, those systems that generate huge profits every month - month after month - and never lose.... while forgetting that making huge profits means taking huge risks. Meanwhile, the winners - those few human beings that can control their emotions - try to find systems that take smaller risks. Sure, the profits aren't as amazing, nor as consistent. Sometimes these systems lose money. But perhaps "profit consistency" is the trading-system equivalent to a boob job: it looks nice, but it doesn't hold up over time.  As a bonus to my readers, I've prepared a list of Ugly Girlfriends. These are trading systems that might get overlooked when it's time to invite the girl to the prom, but with whom you actually stand a good chance of enjoying your night. See the Ugly Girlfriends list here: http://www.collective2.com/uglygirlfriends 1 Interestingly, the converse of this is not necessarily true. Just because a trading system does not make money, this does not mean it is taking no risk. Lack of profit does not mean lack of risk. But presence of profits does mean presence of risk. Too bad, huh? On this page, and others within this Web site, you are going to read about trading systems and their performance. It's important that you understand that all results reported on these pages must be treated as hypothetical results. Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program, which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results. For further technical information about how hypothetical prices are determined on this site, see this page. |